A insurance policy provides individuals and their families peace of mind and financial security. Insurance companies must manage policies to ensure seamless operations and optimal customer service. In this blog post, we will explore the features and benefits of Insurance Management in ERPNext, a comprehensive Enterprise Resource Planning (ERP) software solution. With its robust features, ERPNext simplifies policy management, claim processing, and agent commissions, and generates insightful reports for effective decision-making. Let’s delve deeper into the key features that make Insurance Management in ERPNext a game-changer for insurance companies.

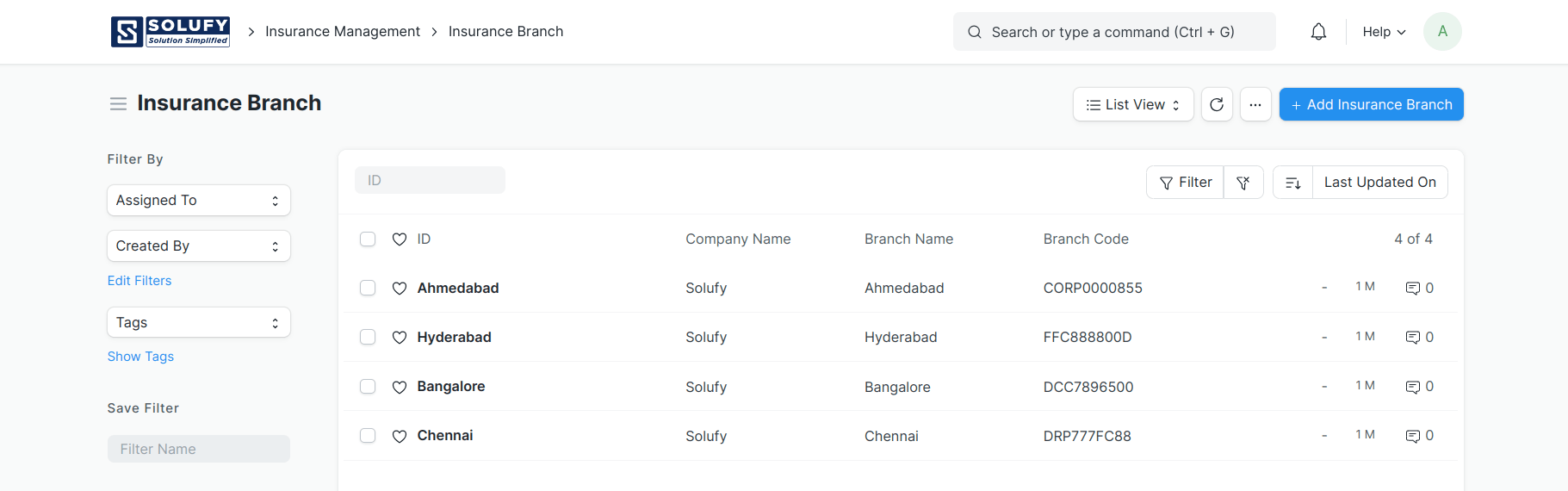

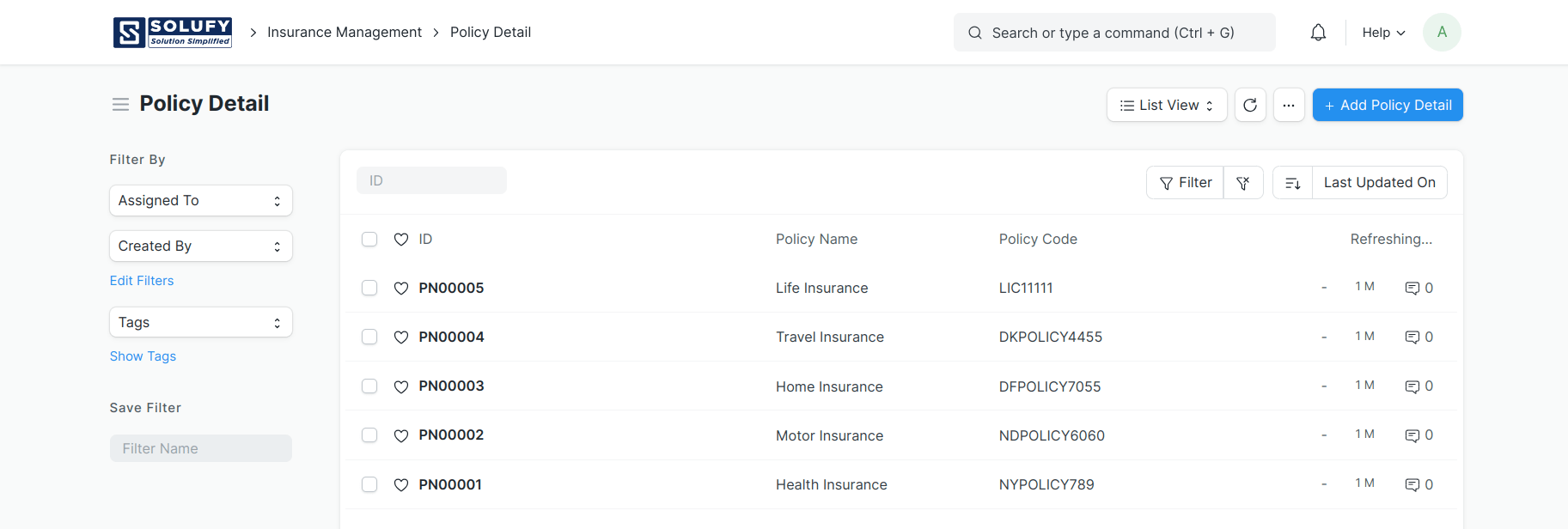

Branch and Policy Management:

With ERPNext’s Insurance Management Module, you gain complete control over branch operations and policy details. Also you can create and manage multiple branches, ensuring workflow management.

Additionally, policy details such as scheme name, policy code, duration, coverage amounts, loan provisions, and GST rates can be easily recorded and accessed, simplifying policy administration.

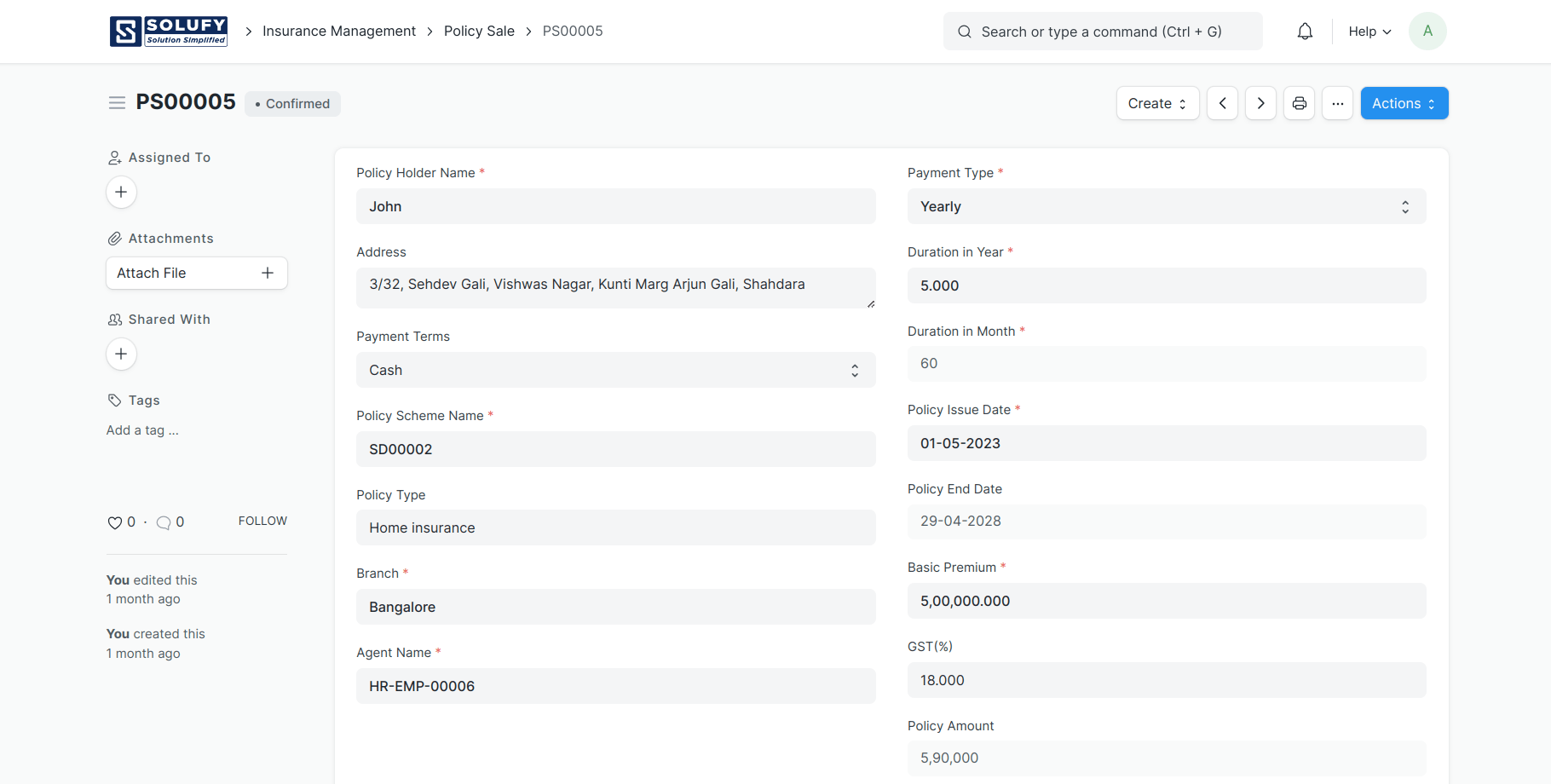

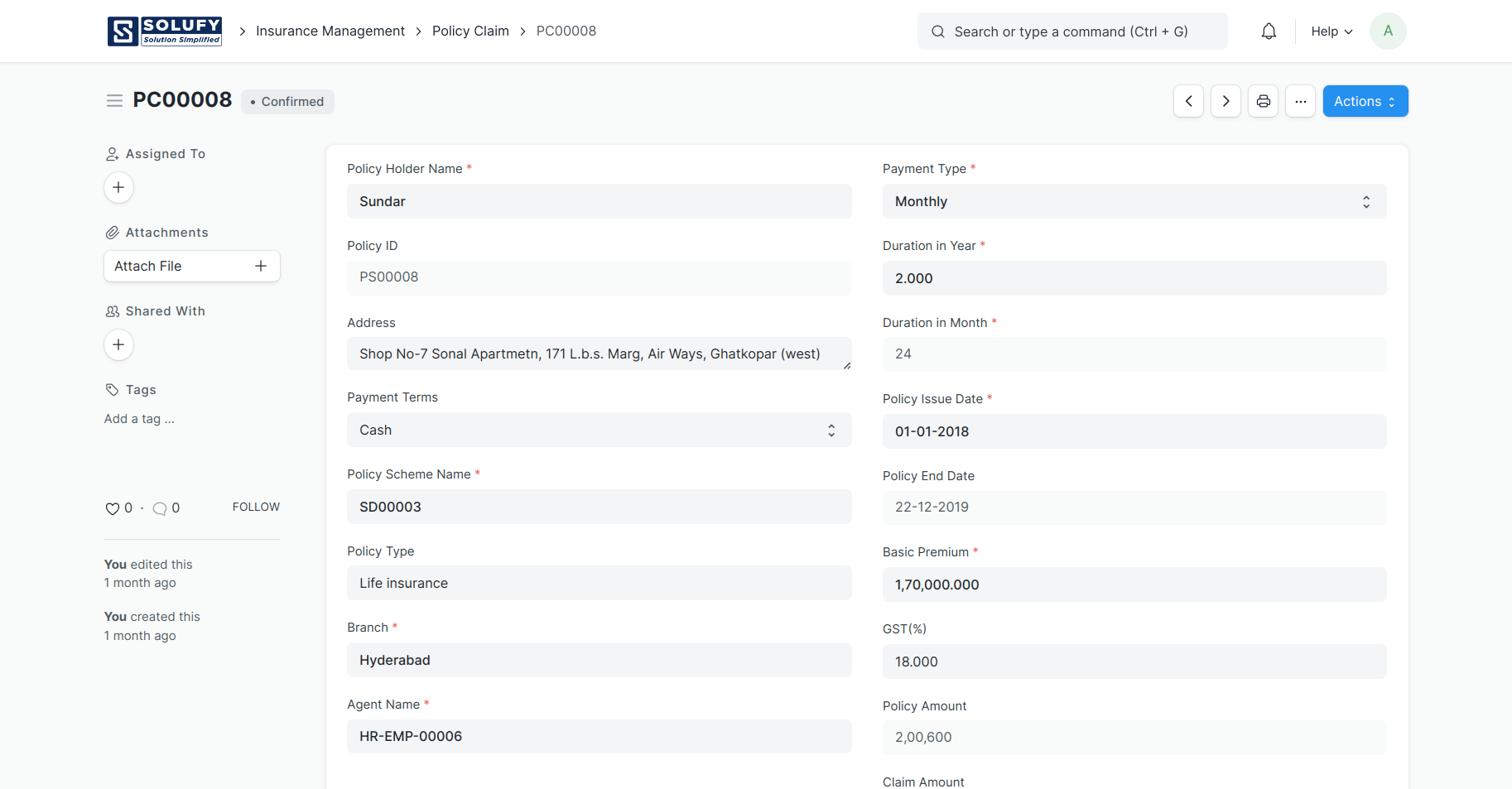

Flexible Policy Creation:

ERPNext allows you to create various types of policies tailored to meet the diverse needs of customers. You can define different payment modes, including yearly, half-yearly, monthly, or quarterly, offering flexibility to policyholders. Furthermore, you can set policy durations to align with customer preferences and efficiently manage policy terms.

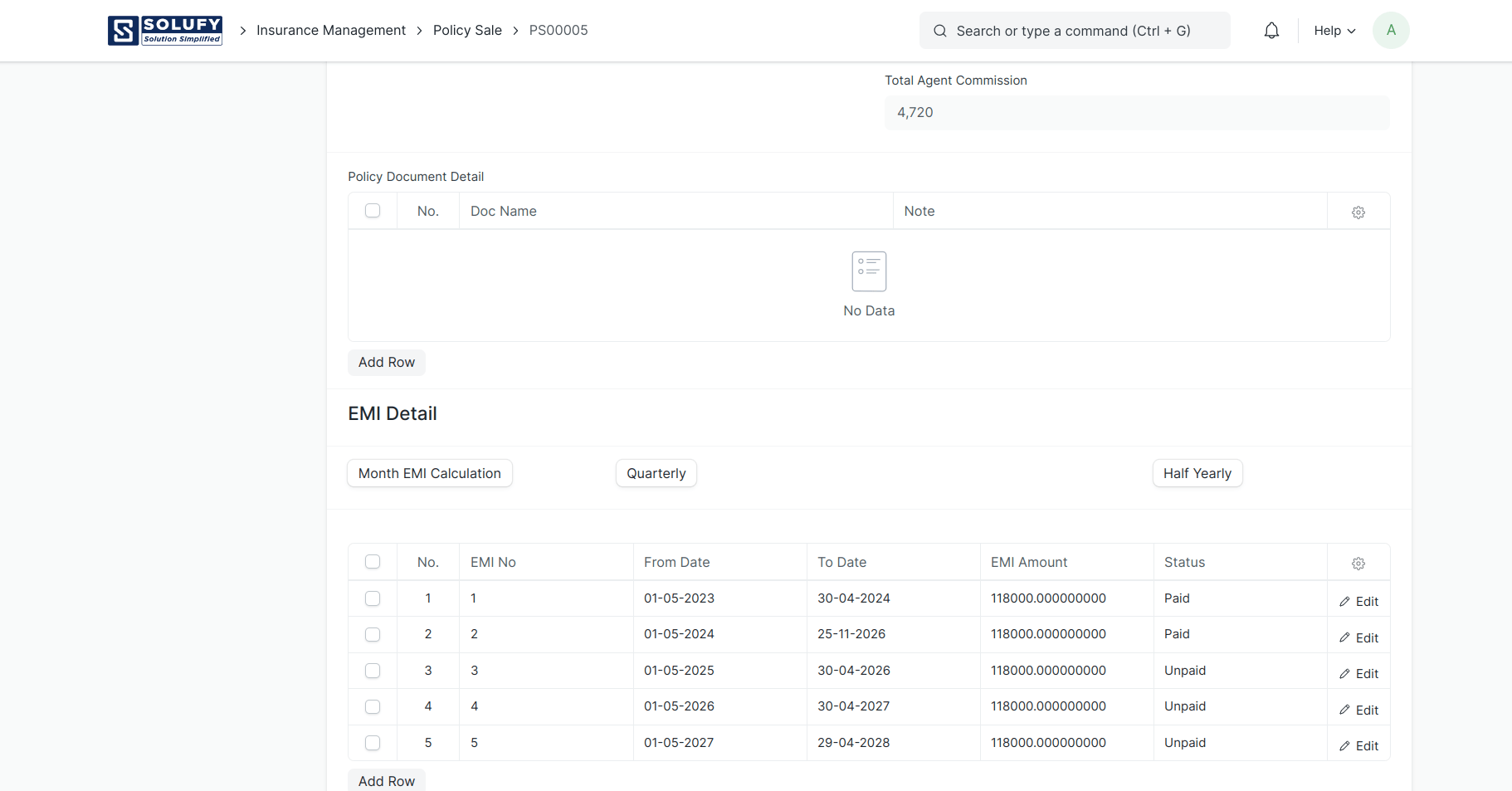

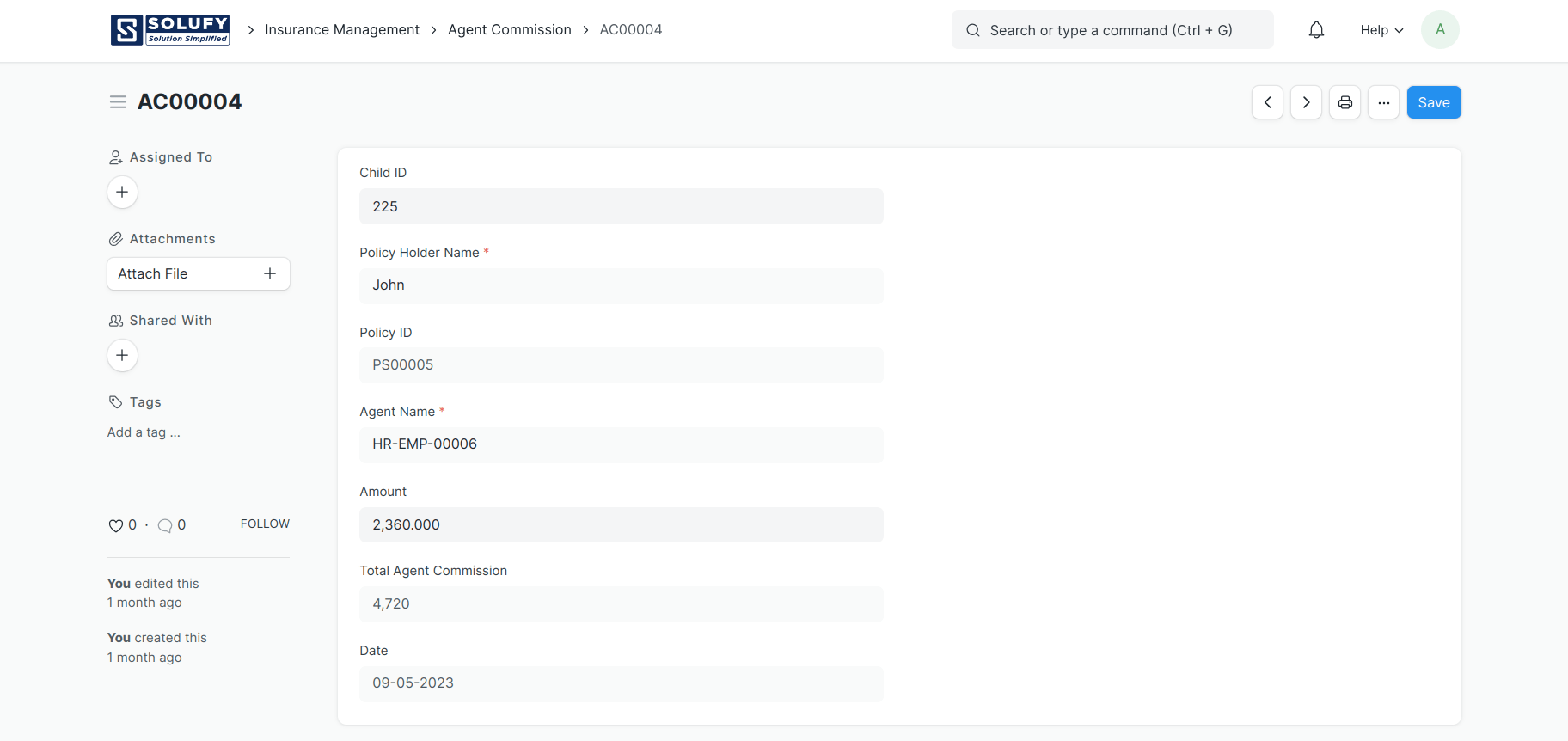

Premium Calculation and Agent Commission:

Calculating premiums accurately is crucial for insurance companies. ERPNext’s Policy Management feature automates premium calculations based on the policy type, payment mode, duration, and policy issue date. It even incorporates GST rates, ensuring precise calculations.

Moreover, the system automatically calculates agent commissions once the policy premium is paid by the customer, streamlining the commission process and reducing manual effort.

Policy Sale Reporting:

Generating comprehensive and professional policy sale reports is effortless with ERPNext. The system generates PDF reports summarizing policy details, enabling easy sharing with customers. Attachments and notes can be added to provide additional information, facilitating transparent communication between insurance companies and policyholders.

Efficient Claim Management:

ERPNext’s Claim Management module simplifies and accelerates the claims processing workflow. Once a policy expires, customers can initiate the claim process. LIC officers can easily access and verify policy information, ensuring accurate and timely claim approvals. Streamlining the claim management process enhances customer satisfaction and enables faster claim settlements.

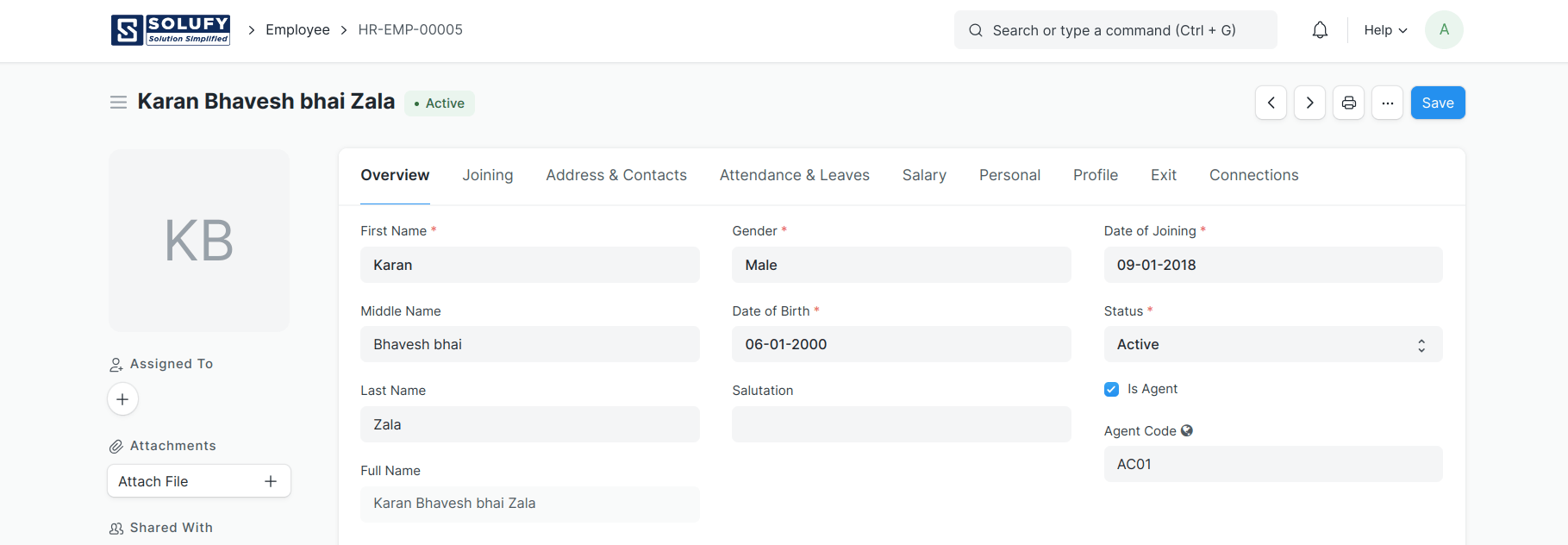

Customer and Agent Management:

Managing customer and agent records is made seamlessly with ERPNext’s Customer and Agent Management modules. You can easily create and maintain customer records, ensuring efficient customer relationship management. Similarly, agent records can be conveniently recorded, including personal data, performance metrics, and commission details. Having centralized access to customer and agent information facilitates effective communication and improves overall efficiency.

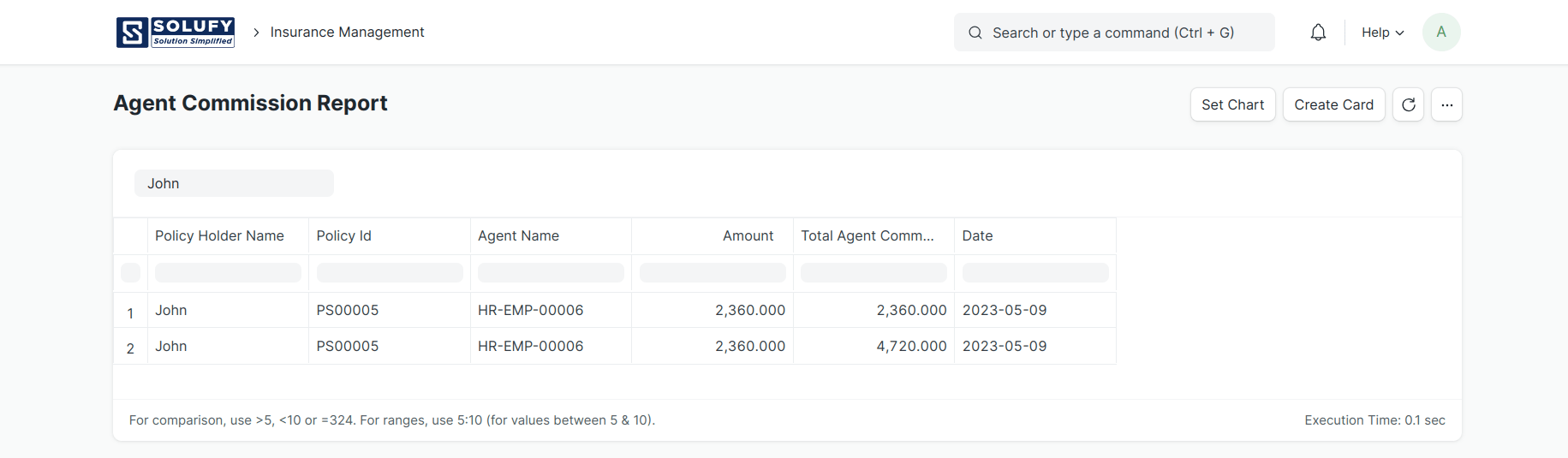

Insightful Reports:

ERPNext provides a range of key reports that empower insurance companies to make data-driven decisions. The Agent Commission Report allows you to track and analyze agent commissions, providing insights into agent performance and compensation.

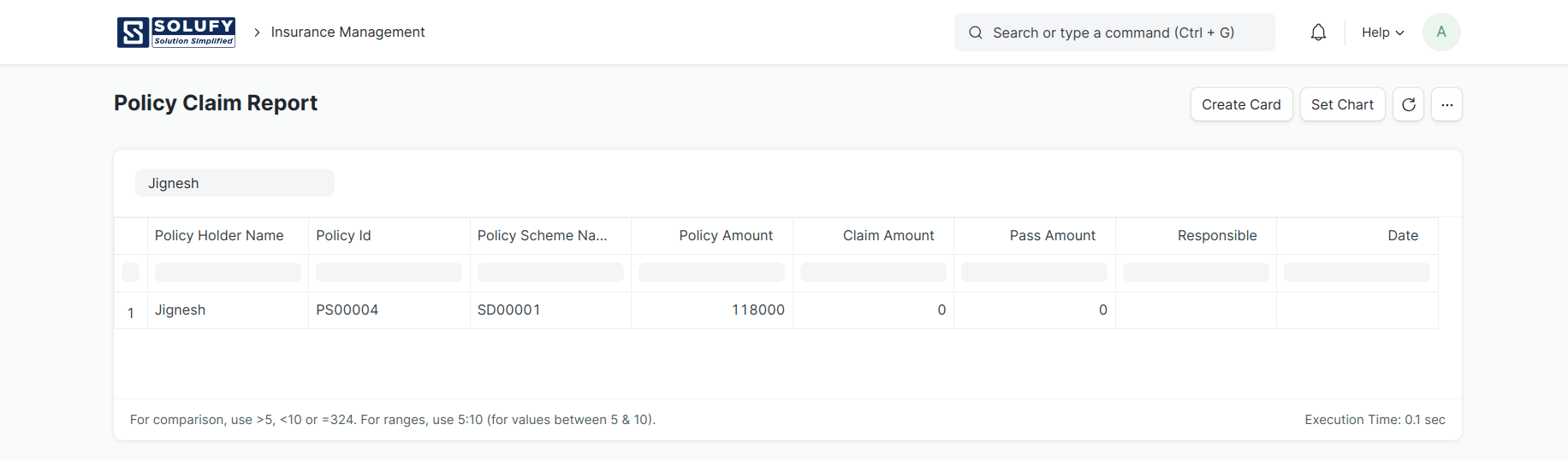

The Policy Claim Report helps monitor claim-related activities, ensuring transparency and efficient claims processing.

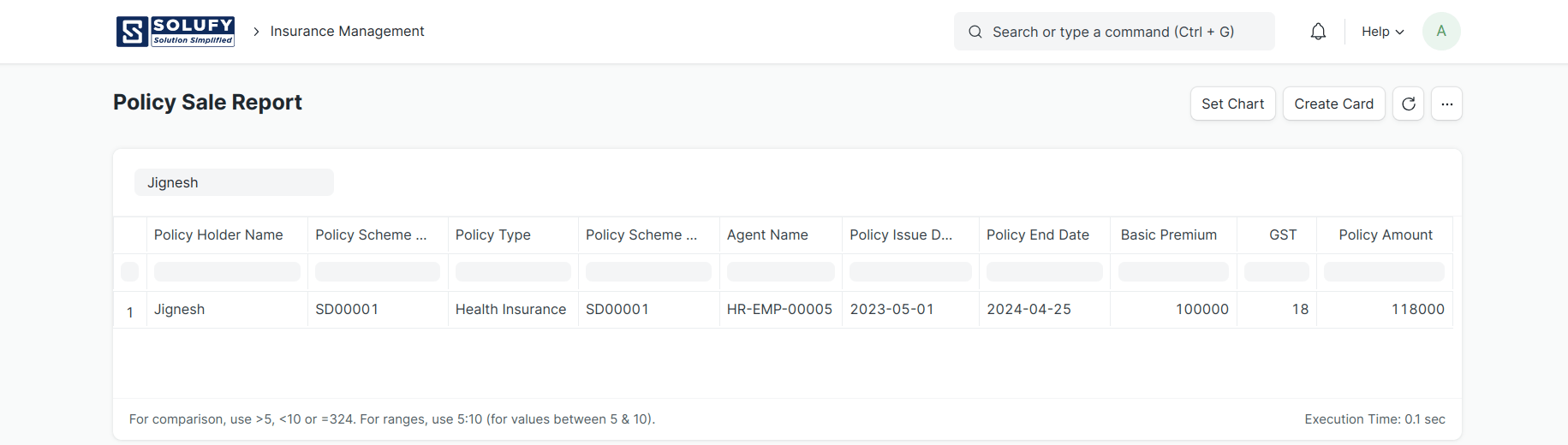

Additionally, the Policy Sale Report presents detailed policy information, aiding in strategic planning and identifying popular insurance plans.

Conclusion:

Insurance management is paramount for insurance companies to thrive in today’s competitive market. ERPNext’s Insurance Management module offers a comprehensive solution to streamline branch operations, policy creation, premium calculations, claim management, and agent commission tracking. With robust reporting capabilities, insurance companies can gain valuable insights, enhance customer satisfaction, and make informed business decisions. By leveraging the features of ERPNext’s Insurance Management, insurers can optimise their operations, deliver exceptional customer service, and stay ahead in the dynamic insurance landscape.

🛒 To Buy Now: https://bit.ly/insurance-management-app-V14

🌐 To Get More Details: https://bit.ly/insurance-management-software